Presented by: Ryan Maroney, CFP®

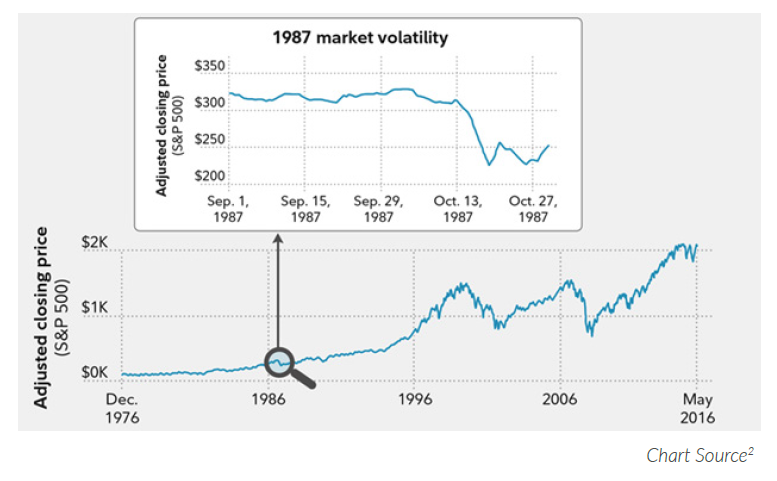

The year in brief. Investors will likely remember 2016 as a year of two momentous votes and one monetary policy decision. This year brought the Brexit referendum in the United Kingdom and a surprise presidential election victory for Donald Trump, and it now appears probable that the Federal Reserve will raise interest rates in December. As Thanksgiving week began, the S&P 500 sat comfortably near 2,200, while the Dow Jones Industrial Average pushed toward breaking 19,000. Some analysts felt both indices would post single-digit advances in 2016, but they may yet surpass those expectations – the S&P was up 7.3% YTD when Thanksgiving week started, and the Dow had advanced 8.6% YTD. Some major overseas indices were also in line for nice 2016 gains. Away from the equity markets, 2016 has been a fine year for commodities, with oil prices rebounding, and a great year for home sales. Investors approached the holidays in a bullish mood.1

Domestic economic health. Economically speaking, 2016 resembles 2015: a poor first quarter, then improved GDP in succeeding quarters. An anemic 0.8% GDP reading for Q1 preceded 1.4% growth in Q2 and a 2.9% rate of expansion in Q3 (a two-year high).2

The headline jobless rate had been at 5.0% in December 2015; by May 2016, it had descended to 4.7%. Then it rose and fell again to end up at 4.9% in October. The U-6 rate, measuring underemployment as well as unemployment, jumped 0.7% to 10.5% in January, but fell to 9.2% by October.3,4

On Main Street, the pace of consumer spending flattened in March, jumped 1.1% in April, retreated 0.1% in August, and then advanced 0.5% in September to close out the third quarter. Consumer sentiment indexes drifted lower as the year unfolded. The University of Michigan’s household sentiment index ended 2015 at 92.6 and was one point lower by October 2016; its 2016 high point of 94.7 came in May. The reading on the Conference Board’s consumer confidence gauge has varied from 92.4 to 103.5 this year; at 98.6 in October, it was 2.3 points higher than where it was in December.5,6,7

The Institute for Supply Management’s twin purchasing manager indices, tracking the growth of American manufacturing and services firms, showed the sectors in good shape. ISM’s non-manufacturing PMI went from 55.8 in December 2015 to 54.8 ten months later; despite the decline, the distance above the 50 mark indicates a solid rate of expansion. The Institute’s manufacturing PMI came in at 51.9 in October, up from 48.0 last December.8,9

By October, annualized consumer inflation had hit 1.6%, the highest level since October 2014. Energy prices increased 3.5% in October, their largest monthly jump in more than three years (gas prices rose 7.0% last month).10

At this writing, the Federal Reserve seems poised to increase the benchmark interest rate in December. This month, Fed chair Janet Yellen told Congress that a rate move could occur “relatively soon,” calling current monetary policy “only moderately accommodative.”11

Global economic health. This past summer, voters in the United Kingdom decided that the country should leave the European Union. This seismic geopolitical event has yet to play out, but the time frame for it has been established: U.K. Prime Minister Theresa May says that she will invoke Article 50 of the Lisbon Treaty in March 2017 at the latest, paving the way for the nation’s exit from the E.U. by summer 2019.12

The eurozone economy did not fall apart in the wake of the vote. Its annualized GDP rate was at 1.4% when the third quarter ended (its Q3 GDP advance was 0.3%), and its yearly inflation was still minimal – just 0.5% as of October. Some economists are expecting things to pick up in Q4.13

The Philippines has replaced China at the top of the economic growth rankings for the Asia Pacific region. Its Q3 GDP stood at 7.1% versus 6.7% for the P.R.C.14

China’s own economy showed signs of renewed strength this fall. In October, its industrial output rose 6.1%; that marked the sixth straight month of gains of 6.0% or greater. In October, the Republic’s official non-manufacturing PMI showed the Chinese service sector growing at the fastest pace in four months.15

World markets. By November, major YTD gains had been amassed by three emerging market indices: Russia’s RTS was up 30.9% for the year as of November 18; Brazil’s Bovespa, 38.3%; and Argentina’s MERVAL, 40.3%. The Nikkei 225 and Shanghai Composite were respectively down 5.6% and 9.8% for the year on that date; Hong Kong’s Hang Seng and India’s Sensex had respectively advanced but 2.0% and 0.1% YTD. Pakistan’s KSE 100 was setting the pace for Asia Pacific benchmarks at a gain of 29.0%. Most major European indices were in the red YTD as Thanksgiving week started. The Stoxx Europe 600 was down 7.2% for the year; France’s CAC-40, down 2.9%; Germany’s DAX, off 0.7%; and Spain’s IBEX 35, in the red 9.7%. The U.K.’s FTSE 100 was a notable exception at +8.5% YTD.16

Commodities markets. The dollar strengthened notably in the fall, taking the U.S. Dollar Index to a close of 101.41 on November 18. A year earlier, it had settled at 99.61. More than ten months into 2016, oil and gold were having a very good year – on November 21, WTI crude was up 13.7% from where it had been a year ago, while the yellow metal had risen 13.0% YOY.17,18

How were other key commodities faring as Thanksgiving approached? Here is a quick rundown of YOY performance: corn, -5.1%; soybeans, +17.8%; wheat, -17.1%; cocoa, -27.2%; coffee, +32.6%; cotton, +17.7%; sugar, +30.8%; heating oil, +10.9%; natural gas, +33.1%; unleaded gas, +6.6%; silver, +17.5%; platinum, +8.6%; copper, +24.7%.18

Real estate. Data from the National Association of Realtors showed existing home sales up 0.6% YOY through the end of the third quarter, maintaining a very healthy 5.47 million annual sales pace. New home purchases increased 29.8% during the year ending in September, according to the Census Bureau, with the annual pace of sales at 593,000.19,20

Regarding construction, additional Census Bureau data reveals the pace of housing starts increased 23.3% between October 2015 and October 2016. The rate of permits issued for builders rose 4.6% in that 12-month window. NAR recently stated that the year ending in September saw a 2.4% gain in housing contract activity.21,22

Mortgage rates descended in the middle of 2016, but by late fall, they were close to where they had been a year ago. Interest on a 30-year fixed-rate loan averaged 3.94% in Freddie Mac’s November 17 Primary Mortgage Market Survey, while average interest on a 15-year fixed-rate loan was at 3.14%. In Freddie’s November 19, 2015 survey, a conventional home loan carried an average interest rate of 3.97% and interest on the 15-year FRM averaged 3.18%.23,24

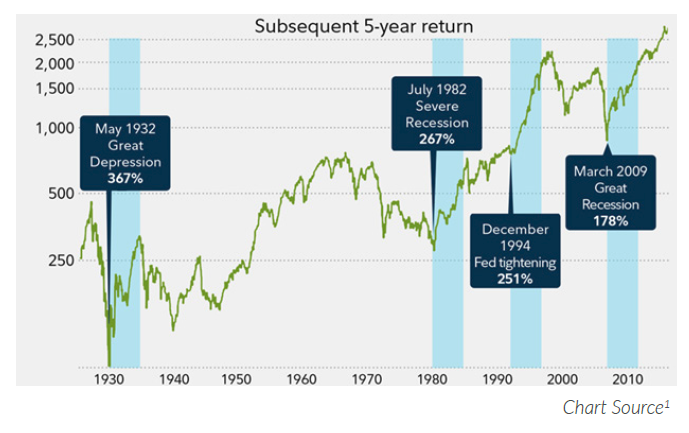

Looking back...looking forward. The Dow, S&P 500, Nasdaq Composite, and Russell 2000 all closed at record highs 72 hours before Thanksgiving. Could the Dow hit 20,000 sometime in early 2017? Will major changes in the federal tax code soon occur? Will American productivity and growth continue to increase? All of this could happen in the coming months or years; in the meantime, investors can be thankful that the market has exceeded some expectations in 2016.25

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. This information has been derived from sources believed to be accurate. Please note - investing involves risk, and past performance is no guarantee of future results. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All indices are unmanaged and are not illustrative of any particular investment.

«RepresentativeDisclosure»

Citations.

1 - markets.wsj.com/us [11/21/16]

2 - tradingeconomics.com/united-states/gdp-growth [11/21/16]

3 - ncsl.org/research/labor-and-employment/national-employment-monthly-update.aspx [11/21/16]

4 - ycharts.com/indicators/us_u_6_unemployment_rate_unadjusted [11/21/16]

5 - tradingeconomics.com/united-states/personal-spending [11/21/16]

6 - tradingeconomics.com/united-states/consumer-confidence [11/21/16]

7 - bloomberg.com/quote/CONCCONF:IND [11/21/16]

8 - instituteforsupplymanagement.org/ISMReport/NonMfgROB.cfm [11/3/16]

9 - instituteforsupplymanagement.org/ISMReport/MfgROB.cfm [11/1/16]

10 - tradingeconomics.com/united-states/inflation-cpi [11/21/16]

11 - marketwatch.com/story/yellen-says-fed-may-hike-interest-rates-relatively-soon-2016-11-17 [11/17/16]

12 - bbc.com/news/uk-politics-37710786 [10/22/16]

13 - nytimes.com/2016/11/01/business/international/europe-economy-gdp.html [11/1/16]

14 - asianjournal.com/news/the-philippines-is-fastest-growing-economy-in-asia/ [11/20/16]

15 - tinyurl.com/gsjro36 [11/20/16]

16 - online.wsj.com/mdc/public/page/2_3022-intlstkidx.html [11/21/16]

17 - marketwatch.com/investing/index/dxy/historical [11/21/16]

18 - money.cnn.com/data/commodities/ [11/21/16]

19 - ycharts.com/indicators/existing_home_sales [11/21/16]

20 - marketwatch.com/story/new-home-sales-run-at-annual-593000-rate-in-september-as-market-grinds-slowly-higher-2016-10-26 [10/26/15]

21 - census.gov/construction/nrc/pdf/newresconst.pdf [11/17/16]

22 - tradingeconomics.com/united-states/pending-home-sales [11/21/16]

23 - freddiemac.com/pmms/archive.html [11/21/16]

24 - freddiemac.com/pmms/archive.html?year=2015 [11/21/16]

25 - marketwatch.com/story/wall-street-stocks-set-to-struggle-for-direction-in-a-holiday-shortened-week-2016-11-21/ [11/21/16]